The Punjab government’s Karobar Card Loan Scheme is an important effort to assist small and medium-sized enterprises. The program provides interest-free financing to business owners who wish to launch or grow their enterprises. The objective is to assist youth-led businesses, increase the economy, and generate job opportunities. The Karobar Loan Scheme’s qualifying requirements, application procedure, and advantages for small business owners will all be covered in this article.

Karobar Loan Scheme

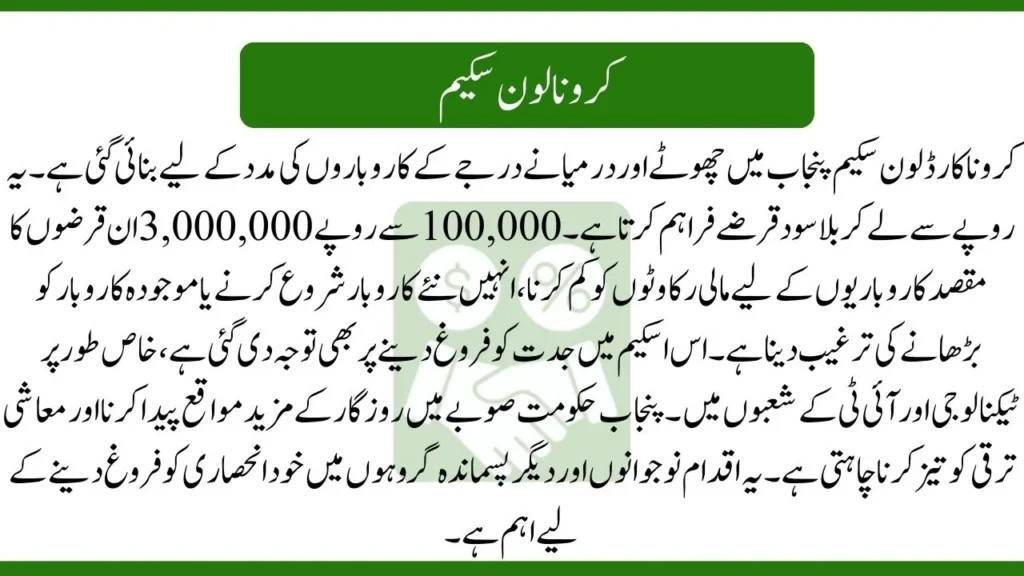

The Karobar Card Loan Scheme is designed to help small and medium-sized businesses in Punjab. It provides interest-free loans ranging from Rs. 100,000 to Rs. 3,000,000. These loans aim to reduce financial barriers for entrepreneurs, encouraging them to start new businesses or grow existing ones. The scheme also focuses on promoting innovation, particularly in the technology and IT sectors. The Punjab Government wants to create more job opportunities and stimulate economic growth in the province. This initiative is crucial for fostering self-reliance among youth and other disadvantaged groups.

| Feature | Details |

| Loan Amount | Rs. 100,000 to Rs. 3,000,000 |

| Interest Rate | 0% (Interest-Free) |

| Target Audience | Small and medium businesses |

| Repayment Period | Flexible repayment plans |

Also Read: Karobar Card Loan Limits and Repayment Details (Complete Details)

Eligibility for the Karobar Loan Scheme

Applicants must fulfill specific eligibility requirements in order to apply for the Karobar Card Loan Scheme. These requirements guarantee that the loan is given to people who can use it most effectively and who actually need it.

- Age Requirement: Applicants should be aged between 18 and 55 years.

- Residency Requirement: The applicant must be a permanent resident of Punjab.

- Business Type: Small businesses and medium-sized enterprises can apply, but priority is given to IT startups.

- Income Level: The scheme is particularly beneficial for low-income families and individuals from economically disadvantaged backgrounds.

These criteria aim to ensure that the scheme supports young entrepreneurs, low-income families, and sectors that can contribute to technological growth.

How to Apply for the Karobar Loan

The application procedure for the Karobar Card Loan is simple and easy to follow. Applicants can apply through the Punjab Small Industries Corporation (PSIC) online portal.

Complete Process

- Step 1: Visit the PSIC official website (http://rozgar.psic.punjab.gov.pk/rozgar/register).

- Step 2: Complete the application form by providing details about your business.

- Step 3: Upload the required documents such as your business registration, CNIC, and business plan.

- Step 4: Submit your application. If your application meets the criteria, you will be notified about your loan approval.

The entire process is straightforward, and the government ensures that eligible applicants get the necessary support without unnecessary delays.

Documents Required for Application

When applying for the Karobar Card Loan, applicants must provide several important documents to verify their eligibility. These include a valid CNIC (Computerized National Identity Card) to confirm identity, and proof of residence, such as utility bills or a rent agreement, to verify residency in Punjab. Additionally, applicants must submit proof of business registration in Punjab, a detailed business plan outlining how the loan will be utilized, and the applicant’s financial goals.

Bank statements from the last six months are required to demonstrate financial stability, and passport-size photographs of the applicant are also necessary. In some cases, applicants must provide income proof to show their current revenue or income source. If needed, guarantor documents may be required to secure the loan. Having all these documents prepared will help expedite the application process.

Benefits of the Karobar Card Loan Scheme

The Karobar Card Loan Scheme offers numerous benefits for small and medium-sized business owners. The most significant advantage is that the loans are interest-free, which reduces the financial burden on business owners. Additionally, the scheme provides flexible repayment terms, allowing business owners to repay the loan in easy installments. The scheme also promotes innovation by prioritizing IT startups and businesses that incorporate technology to enhance their operations.

Furthermore, it encourages self-reliance by helping business owners become financially independent. These benefits make the Karobar Card Loan Scheme a valuable opportunity for businesses in Punjab, particularly for young entrepreneurs and those in the IT sector.

Related: Documents Required for Karobar Card Loan Scheme 2025

Conclusion

The Karobar Card Loan Scheme is a game-changer for small and medium-sized businesses in Punjab. By offering interest-free loans and easy repayment terms, the scheme allows business owners to expand and thrive. It encourages entrepreneurship, creates job opportunities, and boosts the economy. The eligibility criteria are designed to help those who need the most support, especially young and low-income entrepreneurs. If you meet the criteria, don’t hesitate to apply and take advantage of this opportunity to grow your business.

FAQs

Is there an income limit to qualify for the loan?

While there is no specific income cap, low-income applicants are encouraged to apply, particularly those with limited access to finance.

Can the loan be used for non-business purposes?

No, the loan through the scheme must be used strictly for business-related purposes as stated in your application.

What happens if I apply with incomplete documents?

Incomplete applications will be rejected, so ensure all required documents are submitted correctly.

Is there a possibility of early repayment without penalties?

Yes, you can repay the loan early without incurring any penalties, helping you save on future installments.